Storm Damage & Insurance

Dealing with Storm Damage and Insurance Claims

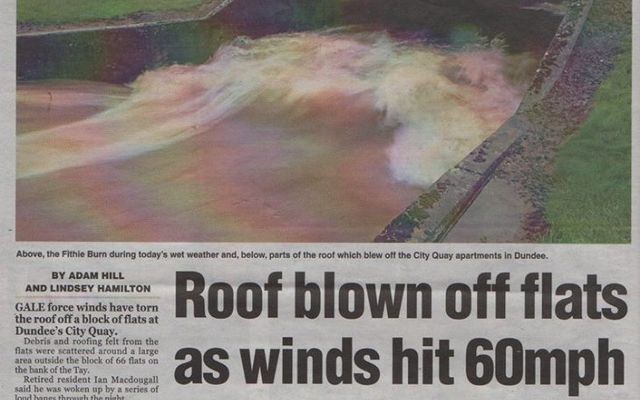

Every year especially in recent years winds can get up to over 100 mph combined with torrential rain usually in autumn and winter, sometimes even in summer.

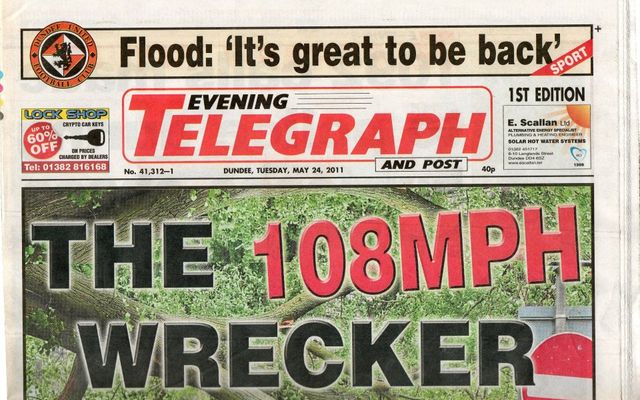

May 2011 front page of the Dundee Evening Telegraph reported winds recorded at 108 mph.

Monikie

December 8th 2011 through to January 3rd 2012 brought similar conditions three times within the space of four weeks.

No roof is built to withstand such conditions, gusty winds can cause damage to old and brand new roofs. After all if a heavy goods lorry can be blown on it’s side in these conditions what chance does a roof have?

Depending on which direction gusts of wind come from your roof can be damaged but surrounding roofs left unscathed. This damage can also occur to PVC’s facias, guttering and dry very systems, this type of damage is not covered by Company Guarantees and that’s when you need to look out your Building Insurance Polices and inform your insurance company you have had storm damage to your property.

Broughty Ferry

Insurances companies are stricter these days regarding storm damage, due to the amount of fraudulent claims and overpriced estimates tendered by some companies who see insurance work as an excuse to exaggerate their prices by double and sometimes more.

Here are some pointers if you have storm damage

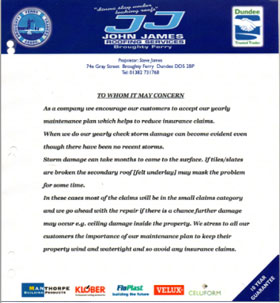

1. Document the date of the storm, we supply photo copies of newspaper headlines with the date at the top and reported weather conditions (see photo) with our invoice. If you are an existing customer who has your roof serviced by us every year we also include a letter to let your insurance company know that you maintain your roof regularly (see point 5 – wear and tear).

The reason for the above is that recent experience has had claims being dealt with in different parts of the country, telling customers claiming, that they have no record of storms on that date according to “their source”, so proof of storm conditions is always essential.

2. If your storm damage means your roof will leak every time it rains and temporary repair is impossible, most insurance companies will let you go ahead with repairs immediately if the estimated cost is between £500 to £1000 and will be approved over the phone. Reason being the same as if you had burst pipes and the water leaking inside your property that by the time you have contacted different contractors, who will be run off their feet because of the volume of calls which follows storms, and waited a week or two on written quotes coming in, the damage to your interior and décor could be ten fold due to on going rain and no roof protection. If your insurance company insists on two estimates then it is your right to explain the above and get the works carried out ASAP as further damage to décor ect would mean a higher claim to your insurance company.

3. You are entitled to uses your own roofing company if any insurance company informs you they will send out their own contractor (fact) as long as it is reasonably priced.

4. If your insurance company ask you to explain the damage to your roof then inform them that your knowledge of roofing is minimal and insist they call your roofing company and speak to someone qualified.

5. If your insurance company insist on sending out an “Independent Assessor” make sure you have your roofer there too so they can go over any damage. This is also where you will need to prove you have had your roof maintained regularly, we recommend all roofs to be checked over once a year (especially older properties), all gutters cleaned our and rain water pipes tested. If you haven’t had any maintenance regularly the Assessor will put the damage down to wear and tear which is a “get out clause” and your insurance claim will not be processed.

Assessors are “Independent Companies” paid to report and legitimise damage to exterior and the interior of insured properties. In my opinion they are there to save insurance companies money and not for your benefit, this is based on past experience. Not to tar them all with the same brush, I have had some site meetings with fair and honest Assessors, who as long as it’s a fair priced estimate approve the claim.

Name and Shamed

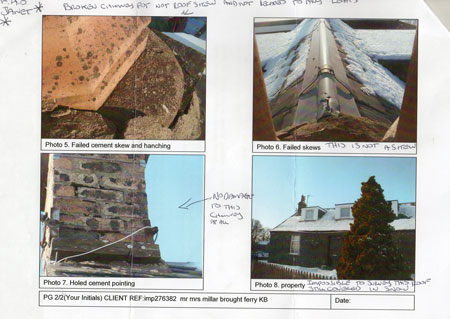

Recently I’ve encountered Imperial Consultants who have sent an (one in particular) Assessor to a few of my regular customers who have had legitimate storm damage and their roof checked over by us for years. On one occasion it was very frustrating because I wasn’t present when he came to assess a roof in Kellas, weeks after severe snow damage which had caused major leaks and gutter damage to the said roof (see photo below). The roof was still covered in snow and ice making it impossible to assess any exterior damage other than the damaged gutter (see photo below). He took photo’s of the snow covered roof then explained to the lady of the house, who knew nothing about roofs, that her roof was old and was nail sick and all damage was due to wear and tear and that there was no claim. This was an old property but had been re-slated with new underfelt 10 years prior.

Week’s later his report arrived with photo’s of the snow and ice covered roof, his terminology for parts of the roof were way off the mark (see photo below), not the words of an expert in my opinion. He claimed the damaged gutter was due to lack of fixings and not caused by snow and ice, the weight of paving slabs sliding down the roof. The outcome was that I had to go and do my own report when the snow had gone. The insurance company paid out on part of the claim months later, but due to unprofessionalism of this individual my client was short changed on a legitimate claim.

Assessors / Snow covered roof report

6. Like most roofing companies most of our work is governed by the weather conditions so our estimates are costed on price work depending on the extent of the damage eg. £50.00 minimum call out charge, £120 small roof repair and so on. Past experience have had had insurance companies ask for a break down of works eg. How many hours worked? Number of men? How many slates/tiles/ridges used? We generally carry our own stock of slates/tiles ect and don’t know to the last nail how much materials are used as some hidden damage can be discovered during works and our men are there to get the job done as quickly and efficiently as possible and don’t keep count of every nail, tile, slate they’ve used as they say its not in their job description which is a fair comment in my opinion. Also, as I’ve explained weather conditions make it impossible to have an hourly rate which doesn’t make sense in any way as they bigger the company the more overheads so higher charges would occur so price work makes more sense.

7. Lastly most insurance companies only pay the insured once the works have been carried out, the contractor has been paid and your account receipted, only then will they issue a cheque to you. As a small company to survive in today’s financial climate we have a payment on completion policy which can be made by chip and pin, cheque or cash. This is for cash flow reasons which has been the downfall of many a business in recent times.